Treasury officials are proposing a amount of spectacular tax hikes in an try to reverse the UK’s piling community financial debt and ward off a economic downturn. The Chancellor is wanting to concentrate on capital gains tax, company tax and pension tax relief in a bid to increase at minimum £20billion in more resources immediately after the coronavirus crisis haemorrhaged the general public purse.

Some of the new steps could be introduced as early as the autumn spending budget, which Mr Sunak is anticipated to announce in late November.

Although the plans have however to be finalised, the £20billion tax raid is expected to largely impact the wealthy, companies, pensions and international aid.

If the measures are accepted 2nd-household entrepreneurs could be strike especially tricky, as the Government looks to deliver capital gains tax in line with income tax.

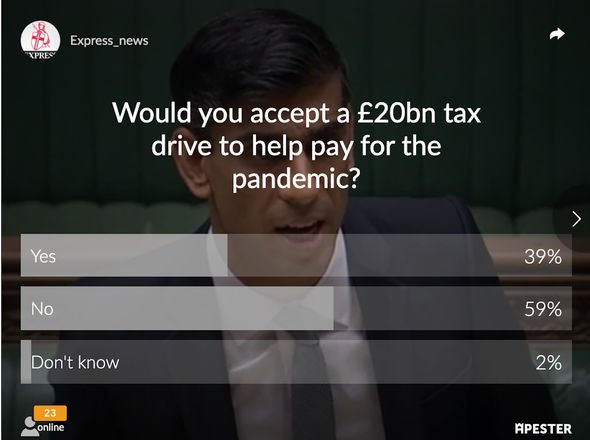

A poll, which ran from 9am to 7pm on August 30, requested, ‘Would you acknowledge £20bn tax drive to aid pay out for the pandemic?’

Britons reject eye-watering £20bn tax hike (Picture: PA)

Community refuse to acknowledge Sunak’s tax hikes (Picture: Convey)

The poll acquired 4,694 votes with 58 percent (2,657) of people objecting to Mr Sunak’s bombshell tax hikes.

1 person stated: “The folks are already struggling as a end result of this pandemic and the extended lockdown.

“The last matter the tough-working taxpayer desires is to see taxes enhance and the income in their pocket cut down.”

One more reader extra: “No will need for tax rises, just minimize general public shelling out.

Browse A lot more: Rishi Sunak warned over designs to raid state pension triple lock

United kingdom superior road ruined by COVID-19 lockdown (Picture: Getty)

“Scrap HS2, no positive aspects to foreigners, scrap vainness projects, no extra payments to the EU, scrap overseas help, these are just for starters.”

Someone else explained: “Absolutely NOT! Use the money we saved on EUSSR charges, or even better, use that for NHS as promised and the trade reward from totally free trade agreements will fork out for corona credit card debt two times about!!!

“Conservatives are intended to be very low tax celebration!”

An additional particular person argued increasing taxes would hinder the restoration relatively than support it.

Do not MISS

Can the significant road survive Covid-19, says Esther McVey MP [COMMENT]

Treasury requires Substantial tax hikes to shell out for coronavirus lockdown [INSIGHT]

Boris Johnson urged by frustrating the vast majority to scrap international aid [REVEAL]

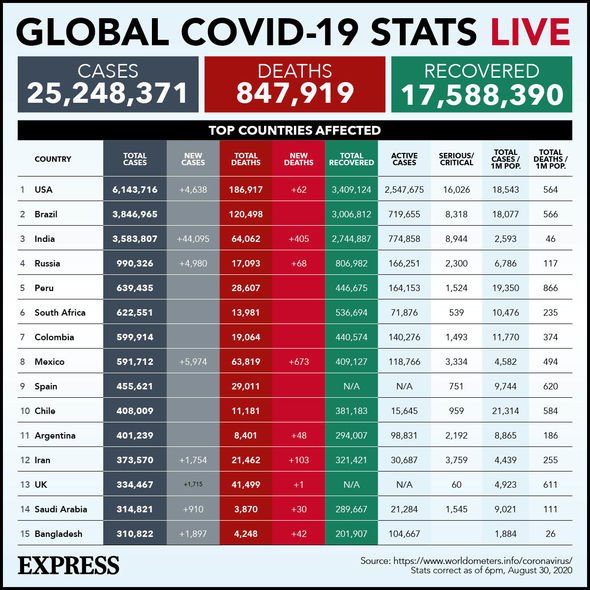

Coronavirus scenarios all over the globe (Graphic: Categorical)

They stated: “No, increased taxes would merely hinder the recovery as folks would have considerably less money to spend in the true economic system.

“How about cancelling all international assist? Which is about £16B saved proper there.

“Cancel HS2 as perfectly and we could have a tax minimize!”

Close to 40 % (1,922) mentioned they have been prepared to support spend for the pandemic when just two percent (115) mentioned they didn’t know.

London’s Oxford Avenue deserted all through lockdown (Graphic: Getty)

A person individual urged the Government to make confident substantial businesses are the to start with to be taxed.

They claimed: “As very long as the initial to be taxed are businesses who pay out small or no tax below.

“It can not be everyday people today who yet once again bear the brunt of these actions.

“No more obligation on fuel while, we already spend a fortune.”

Chancellor Rishi Sunak (Graphic: Getty)

Mr Sunak’s move would see cash gains tax practically double to 40 or even 45 per cent, rather of the latest 28 percent

The modifications to funds gains tax will also influence owners of buy-to-permit homes when they market their residences.

The hike in cash gains is expected to raise up to £14billion a year.

The Treasury is also thinking of mountaineering corporation tax from 19 to 24 percent, which would increase £12billion up coming 12 months by itself, the Sunday Periods stories.

By the 2023-24 economic 12 months, the go would elevate a whopping £17billion.