Impression copyright

Reuters

HSBC’s income for the first 50 % of this year have plunged 65% as it battles the coronavirus downturn.

The UK’s most significant lender posted pre-tax profits of $4.3bn (£3.3bn), when compared to $12.4bn for the exact same period of time very last 12 months.

The tumble was considerably larger sized than analysts had forecast as HSBC was hit by loans turning bad and curiosity prices remaining small.

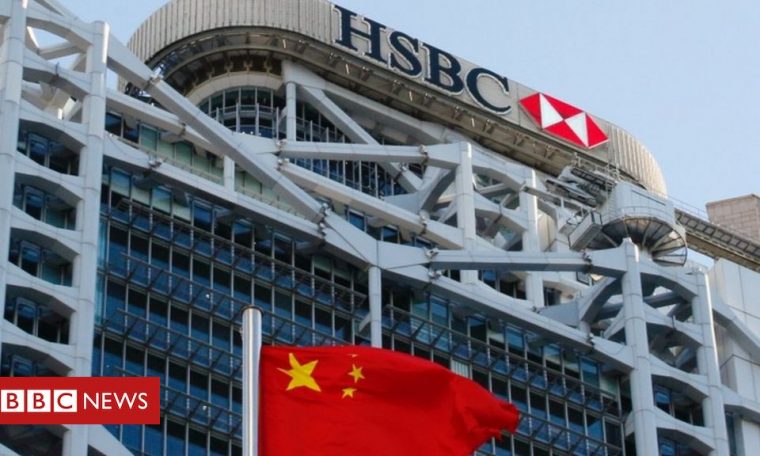

When HSBC is headquartered in London, extra than 50 % of its earnings occur from the Asian monetary hub of Hong Kong.

HSBC explained it has established apart $8bn to $13bn this yr for negative financial loans as it expects far more folks and enterprises to default on their repayments.

This is better than earlier budgeted for, having into account the consequences of the financial downturn.

The financial institution explained it has specified far more than 700,000 payment holidays on loans, credit cards and home loans, delivering much more than $27bn in buyer aid.

HSBC has also been strike by the very low desire price surroundings, which squeeze a bank’s financial gain margins on the loans it supplies. The reduced the fascination fee, the a lot less a lender can make on its lending.

Political tensions

The lender is working with a amount of troubles, not just the monetary downturn brought on by the coronavirus.

It is at the moment embroiled in a political fight over its help of China’s nationwide security law in Hong Kong although pushing forward with a significant restructuring of its global banking functions.

“We will face any political worries that occur with a target on the very long-term requires of our customers and the very best passions of our traders,” HSBC’s group chief main executive Noel Quinn claimed on Monday.

“Existing tensions in between China and the US inevitably produce difficult situations for an organisation with HSBC’s footprint. However, the will need for a financial institution capable of bridging the economies of east and west is acute, and we are very well placed to fulfil this purpose.”

Position cuts

In June, the UK’s premier bank, reported it will force forward with its program to cut 35,000 work opportunities from a worldwide workforce of 235,000 as aspect of a significant restructuring introduced in February.

HSBC chairman Mark Tucker is overseeing the programme to shrink the bank’s functions in Europe and the US.

On Monday, Mr Quinn mentioned that the lender will “speed up implementation of the strategies we announced in February” introducing that “our operating natural environment has modified substantially given that the start out of the 12 months.”

“We will also therefore search at what added steps we have to have to take in light-weight of the new economic natural environment to make HSBC a much better and far more sustainable business enterprise.”

The occupation cuts experienced initially been put on hold throughout the coronavirus outbreak but are now back again on the agenda.

HSBC has previously explained it could wind down or sell its US retail banking operations which could require shrinking its 224-robust US department network by about 30%.

Caught concerning China and the West

It can be Europe’s biggest lender, headquartered in London, but the Hong Kong and Shanghai Banking Corporation can make fifty percent of its revenue in Asia.

And it can be been caught in the midst of progressively tempestuous relations in between China and the West, with the lender expressing help for China’s controversial security legislation in Hong Kong in June, breaking a custom of neutrality.

Chief executive Noel Quinn attempted to reinstate that neutrality now, declaring: “We will deal with any political problems that come up with a aim on the long-term requirements of our shoppers and the finest pursuits of our traders.”

But who are people consumers? Mr Quinn also signalled the resumption of restructuring options which will pivot the business even further towards Asia, with career cuts predicted in the Uk expenditure bank and the American branch community.

Its branding is familiar close to the world, but HSBC is a bank that likes to keep out of the headlines. Nevertheless, as it chases its ambitions, more strain and scrutiny will be challenging to dodge.

Caught in crosshairs

HSBC, alongside with rival banking group Typical Chartered, arrived beneath fireplace for coming out in assistance of China’s controversial nationwide safety regulation for Hong Kong.

Also in June, US Secretary of Condition Mike Pompeo and British isles politicians criticised HSBC for supporting China’s new legislation, which suggests people facial area prosecution for talking out from Beijing.

Mr Pompeo claimed the Chinese Communist Party’s (CCP) “browbeating” of HSBC “need to provide as a cautionary tale”.

The two HSBC and Conventional Chartered have their headquarters in London but receive a important portion of their income in Asia, with Hong Kong serving as a hub for the area.

Last week, Typical Chartered also introduced its 50 %-annually benefits and restated its commitment to Hong Kong.

In a statement, Typical Chartered’s team chairman José Viñals addressed the international tensions over China’s policies in Hong Kong:

“We are convinced that more collaboration – not fewer – is the ideal way to discover a sustainable equilibrium in these elaborate conditions, but we do not hope an simple or fast resolution.

“We do believe, on the other hand, that Hong Kong will continue to perform a essential purpose as an worldwide economical hub and we are thoroughly committed to contributing to its continued good results,” he extra.