United States stocks declined with this Friday (26) The Dow Jones and S&P 500 are suffering their biggest daily percentage declines in months, The regions affected by the pandemic again benefited from a massive retreat after a new potentially vaccine-resistant coronavirus mutation was found.

The Dow Jones fell 2.53% to 34,899.34 points, the S&P 500 fell 2.27% to 4,594.72 points, and the Nasdaq Composite fell 2.23% to 15,491.66.

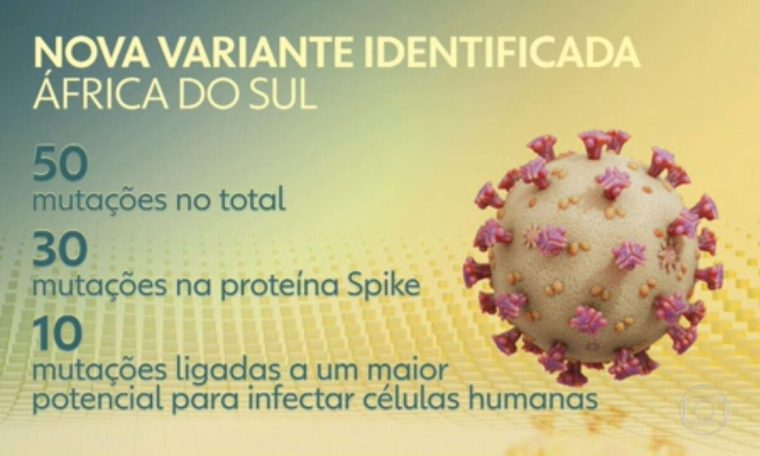

Authorities around the world have reacted with alarm to the coronavirus variant found in South Africa, with the European Union and UK among those to tighten border controls as researchers seek to establish whether the mutation is relevant to vaccines. is resistant.

WHO called an emergency meeting after new tensions were detected in South Africa

- What is known about the new variant discovered in South Africa

The World Health Organization (WHO) said it was a form of “concern” and chose the name “Micron”. With this classification, the new variant was placed in the same group of versions of the coronavirus that had already affected the progression of the pandemic: alpha, beta, gamma and delta.

Stock selling was broad, with major declines in all 11 of the S&P’s top 11 sectors except healthcare, which fell only slightly thanks to strong gains by Covid-19 vaccine makers Pfizer and Moderna.

“What we understand about this version may be bullish over the weekend, and if there is more worry than good news, many people either do not want to hold risky assets on Monday morning, or are afraid that That’s how things might turn out on Monday,” said Keith Buchanan, senior portfolio manager at Global Investments in Atlanta.

The CBOE Volatility Index, better known as the Wall Street fear gauge, rose to its highest level since September 20th.