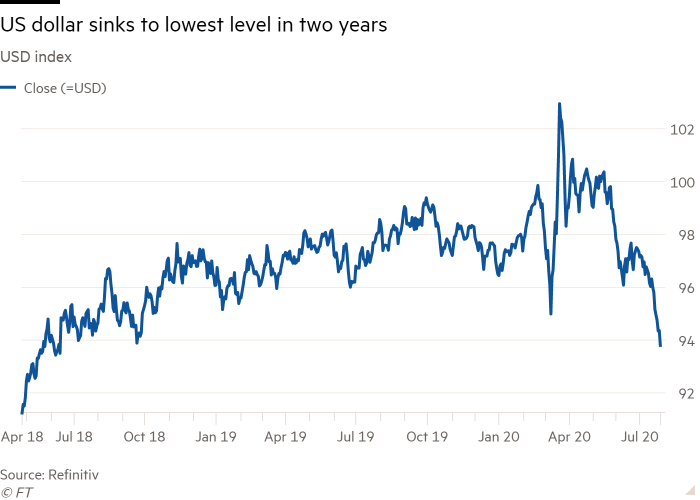

The dollar weakened to a two-12 months reduced on Monday as sharp boosts in US coronavirus situations and flare-ups all around the environment weighed on trader self esteem.

The greenback index, which steps the currency towards a basket of buying and selling friends, slipped .7 for every cent to its cheapest level considering the fact that June 2018, as fears mount that the continuing distribute of Covid-19 in The us will moist the financial restoration.

The bad overall performance of the US currency has supported a rally in gold costs to their all-time high, which climbed on Monday as much as 2.2 per cent to a document $1,944.71 for every troy ounce.

“The factor that is modified in the last couple times is that it is not just gold which has absent up in opposition to the greenback, but practically anything,” stated Kit Juckes, overseas trade strategist at Société Générale.

The Japanese yen, a further perceived haven, strengthened .8 for every cent to a four-month significant of ¥105.30 per dollar. The pound rose .8 for every cent to $1.2848 and the euro acquired .5 for every cent to $1.1745. The euro, which is the biggest body weight in the greenback index, has not traded above $1.17 given that late September 2018.

“That’s partly pushed by a feeling that the US is getting a tougher time managing the virus than some others, which will see the US financial state underperform,” Mr Juckes extra.

Florida overtook New York on Sunday as the condition with the 2nd-optimum quantity of verified infections, behind only California, as fatalities in some of the most populous US states have adopted the surge in scenarios.

Futures tied to the S&P 500 were being up .5 for each cent on Monday, pointing to the US shares benchmark index opening higher when trading starts on Wall Road after falling in the previous two periods.

European fairness marketplaces have been flat in morning buying and selling, with the regional benchmark Stoxx index overturning early losses to get .1 per cent and London’s FTSE 100 down .1 for each cent — weighed down by considerable losses for airlines following the British isles warned on travel to Spain.

“This weekend we maybe acquired a glimpse of how challenging lifestyle will be this wintertime without having a vaccine,” stated Deutsche Lender strategist Jim Reid, pointing to increasing scenario quantities in the US and parts of Europe and Asia.

Spain has faced a sharp uptick in scenarios across a few locations, with Germany also reporting a increase. The problem has continued to deteriorate throughout Latin The usa whilst Asia, Hong Kong and the Australian condition of Victoria have also seen major boosts.

The dollar’s weakness came ahead of Republicans unveiling their proposals for a new round of stimulus later on Monday. Present positive aspects, handed at the start out of the coronavirus disaster in March, are thanks to expire at the conclusion of the month and economists fear the withdrawal or reduction of stimulus at a fraught instant for the world’s largest overall economy.

Traders are also on the lookout in advance to a meeting of the US Federal Reserve’s rate-setters on Wednesday and the launch of US next-quarter gross domestic product or service figures on Thursday. Anticipations are for the central financial institution to hold fascination rates at shut to zero.

Tension between the US and China was heightened at the weekend by the arrest of a Chinese researcher who American authorities mentioned had been hiding in the country’s San Francisco consulate. Washington has alleged that the researcher is a member of the Chinese military.

Qi Gao, a forex strategist at Scotiabank, claimed tit-for-tat closures of consulates in Houston and Chengdu final 7 days had stoked stress to the point that it had weighed on the US forex. “In the coming months you are going to see the greenback weakening even more,” he added.

Asian equity markets were mixed. China’s CSI 300 index of Shanghai and Shenzhen-mentioned stocks added .5 for each cent though Hong Kong’s Cling Seng slipped .4 per cent.