Now gold is tipped to get to $3,500 as stock sector turmoil and future inflation fears thrust buyers to seek out out the long-standing harmless haven

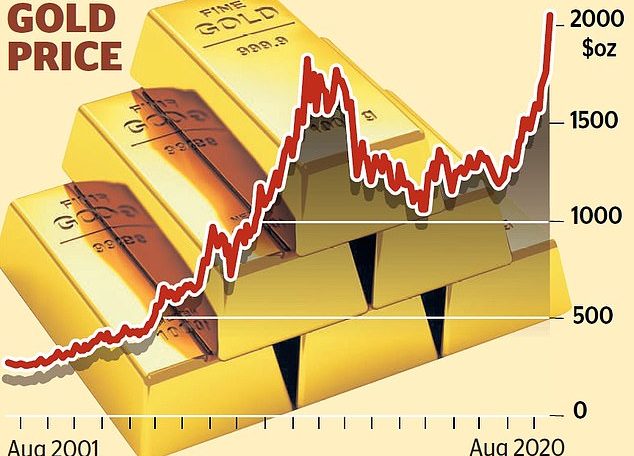

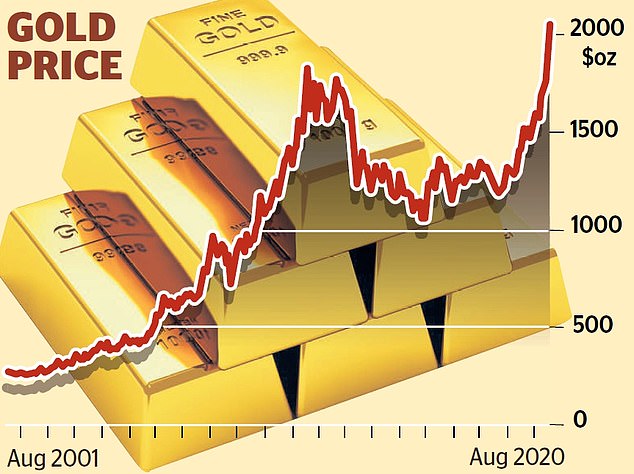

Gold selling prices soared to file highs soon after breaking by way of the $2,000 an ounce mark for the very first time at any time.

Traders trying to get a haven from inventory market turmoil caused by the pandemic have piled into the precious metallic.

It has now rallied by 35 for every cent because the start off of 2020 and rose 1.3 per cent to $2,044 for each troy ounce final night.

Record higher: Gold has now rallied by 35 for each cent since the start out of 2020 and rose 1.3 for each cent to $2,044 for each troy ounce past night

But bullish analysts think this is just the starting – and imagine it could attain $3,000 or extra by the finish of up coming year. The rise boosted shares in London’s major cherished metals miners.

Blue-chip groups Fresnillo and Polymetal equally rose 6 for every cent, although mid-cap firms Hochschild Mining and Centamin surging 14 per cent and 10 per cent respectively.

Gold experienced been growing steadily because the commence of 2018 till the coronavirus strike.

Just after see-sawing in February and March it has risen sharply as anxieties have grown about the influence the outbreak will have on the world economic system.

George Cheveley, a fund supervisor at Ninety One particular, stated: ‘It’s uncertainty about irrespective of whether the globe plunges into recession future year or recovers, spurred on stimulus income. When you believe of both of those results, gold has a location.’

Gold is seen as a harmless way for an trader to shop worth through moments of economic uncertainty –and a way to hedge versus inflation and currency fluctuations.

Price ranges have spiked not long ago as virus scenarios have stored mounting and governments have unveiled multi-billion-greenback stimulus programs and decreased interest costs.

This means that ordinarily harmless and responsible investments, these kinds of as govt bonds, could yield pretty much no return.

A lot of common buyers keen to acquire component in the rally have snapped up shares in shown gold miners, which have noticed their earnings leap this yr in tandem with price ranges.

But the most typical way to devote in gold is to obtain an exchange-traded fund (ETF) or an exchange-traded commodity (Etc). These are investment automobiles outlined on the stock marketplace that observe the price tag of an asset, such as gold.

Peter Snooze of 7 Expense Management advisable the £10.3billion Invesco Bodily Gold Etc, which has an yearly fee of .19 for every cent.

There are also cash that spend in gold, operate by organizations these kinds of as Merian and Investec, although Blackrock Gold & Typical is possibly the very best-recognized.

And it truly is grow to be easier for retail buyers to get physical gold through platforms this sort of as Bullion Vault – nevertheless the Royal Mint also sells coins and bars.

Ploughing hard cash into gold, in whatever kind, could spend off. Investors at Lender of The us feel rates could achieve $3,000 an ounce by the end of 2021.

Some are even much more optimistic, with Barry Dawes, govt chairman at Martin Position Securities, predicting it could hit $3,500 in just two many years.

Warren Patterson, head of commodities tactic at ING, stated: ‘Given that very low fees and a weaker US dollar are probably to persist, we think there is nonetheless further more upside for gold rates.’

Silver charges have also surged by far more than 30 per cent so significantly this calendar year. Analysts feel it will do perfectly when the earth financial state begins to rebound, as silver has plenty of industrial makes use of.

Citi analysts have explained that if Joe Biden wins the US presidency in November then silver, which is now about $27, could increase if he provides his sweeping green infrastructure program.

Ad